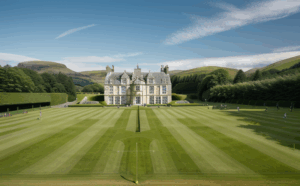

The future of the iconic Kilgraston estate in Perthshire is taking a new and exciting direction, as its new custodians, Lumara Capital Ltd, publicly announce their comprehensive plans for the former school site. This significant development comes as the new owners firmly dismiss widespread online speculation regarding the building’s future use.

Reports circulating digitally suggesting that the esteemed property, nestled near Bridge of Earn, was destined to house asylum seekers have been unequivocally refuted. Syed Eitizaz, a leading figure at Lumara Capital, emphatically stated these claims are “entirely unfounded and wholly inaccurate,” providing much-needed clarity for the local community.

Instead, Lumara Capital, a property development firm based in Salford and co-managed by Mr. Eitizaz and Ahmed Zohaib, is charting a course towards revitalising Kilgraston as a dynamic hub catering to both residential and leisure needs. This ambitious undertaking aims to breathe new life into the expansive estate, which closed its doors as a private school in August 2024, at which point it carried reported debts of £900,000. Transforming a Landmark: Leisure and Living Opportunities

The vision for Kilgraston is centred on reactivating its impressive array of facilities for broader community benefit. This includes the restoration and reopening of the swimming pool, tennis courts, modern sports hall, and the well-regarded equestrian centre. The re-introduction of these amenities promises to offer significant opportunities for local sports clubs, educational groups, and individuals across Perth and Kinross, providing much-missed resources for health and recreation.

Beyond leisure, the estate is set to welcome a diverse range of commercial and residential ventures. Lumara Capital is actively seeking proposals from various operators interested in utilising the unique spaces within Kilgraston. Potential uses span across education, vocational training, essential healthcare services, veterinary facilities, specialised sports programmes, and creative arts enterprises. This inclusive approach seeks to embed Kilgraston once again into the fabric of regional life, creating employment and service provision where a void was left by the school’s closure.

In a further commitment to community integration, properties within the estate, including a selection of houses and flats, will be made available for rent on the open market. These homes will be offered to all prospective tenants under standard, transparent tenancy arrangements, contributing valuable housing stock to the Bridge of Earn area and wider Perthshire. A Long-Term Investment in Perthshire’s Heritage

Lumara Capital’s acquisition of Kilgraston, completed for a reported £1,730,000, signifies a substantial investment in the region’s economic and social landscape. Mr. Eitizaz underscored the company’s dedication to a sustainable, long-term future for the estate. He articulated their mission: “Our goal is to work in partnership with forward-thinking organisations that can unlock the estate’s full potential and create long-term value for both the community and the wider area.”

He further added, “Kilgraston is a special place, and we are committed to ensuring that it continues to serve as a valued asset for the people of Bridge of Earn, Perthshire, and beyond. We warmly welcome all enquiries and conversations about Kilgraston’s future.” This statement reflects a profound understanding of the estate’s historical significance and its cherished place within the local consciousness.

The transformation of Kilgraston promises to be a beacon of regeneration, turning a recent closure into a renewed opportunity for residential comfort, recreational enjoyment, and innovative commercial activity. Residents and stakeholders across Perthshire are encouraged to engage with Lumara Capital as these exciting plans begin to take shape, ensuring the estate’s next chapter truly serves the heart of the community.

Reports circulating digitally suggesting that the esteemed property, nestled near Bridge of Earn, was destined to house asylum seekers have been unequivocally refuted. Syed Eitizaz, a leading figure at Lumara Capital, emphatically stated these claims are “entirely unfounded and wholly inaccurate,” providing much-needed clarity for the local community.

Instead, Lumara Capital, a property development firm based in Salford and co-managed by Mr. Eitizaz and Ahmed Zohaib, is charting a course towards revitalising Kilgraston as a dynamic hub catering to both residential and leisure needs. This ambitious undertaking aims to breathe new life into the expansive estate, which closed its doors as a private school in August 2024, at which point it carried reported debts of £900,000. Transforming a Landmark: Leisure and Living Opportunities

The vision for Kilgraston is centred on reactivating its impressive array of facilities for broader community benefit. This includes the restoration and reopening of the swimming pool, tennis courts, modern sports hall, and the well-regarded equestrian centre. The re-introduction of these amenities promises to offer significant opportunities for local sports clubs, educational groups, and individuals across Perth and Kinross, providing much-missed resources for health and recreation.

Beyond leisure, the estate is set to welcome a diverse range of commercial and residential ventures. Lumara Capital is actively seeking proposals from various operators interested in utilising the unique spaces within Kilgraston. Potential uses span across education, vocational training, essential healthcare services, veterinary facilities, specialised sports programmes, and creative arts enterprises. This inclusive approach seeks to embed Kilgraston once again into the fabric of regional life, creating employment and service provision where a void was left by the school’s closure.

In a further commitment to community integration, properties within the estate, including a selection of houses and flats, will be made available for rent on the open market. These homes will be offered to all prospective tenants under standard, transparent tenancy arrangements, contributing valuable housing stock to the Bridge of Earn area and wider Perthshire. A Long-Term Investment in Perthshire’s Heritage

Lumara Capital’s acquisition of Kilgraston, completed for a reported £1,730,000, signifies a substantial investment in the region’s economic and social landscape. Mr. Eitizaz underscored the company’s dedication to a sustainable, long-term future for the estate. He articulated their mission: “Our goal is to work in partnership with forward-thinking organisations that can unlock the estate’s full potential and create long-term value for both the community and the wider area.”

He further added, “Kilgraston is a special place, and we are committed to ensuring that it continues to serve as a valued asset for the people of Bridge of Earn, Perthshire, and beyond. We warmly welcome all enquiries and conversations about Kilgraston’s future.” This statement reflects a profound understanding of the estate’s historical significance and its cherished place within the local consciousness.

The transformation of Kilgraston promises to be a beacon of regeneration, turning a recent closure into a renewed opportunity for residential comfort, recreational enjoyment, and innovative commercial activity. Residents and stakeholders across Perthshire are encouraged to engage with Lumara Capital as these exciting plans begin to take shape, ensuring the estate’s next chapter truly serves the heart of the community.